July 31, 2018

In This Edition…

- President’s Message

- Executive Director’s Corner

- WEDC Bulletin

- Guest Column: Wisconsin on Great Financial Footing to Win 21st Century

- Latest Edition of WEDA’s Toolbox Newsletter Now Available Online

- WEDA Legislative Spotlight

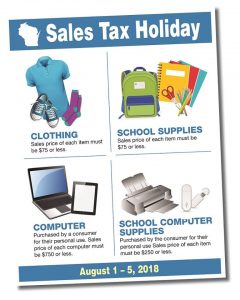

- Wisconsin’s “Back-To-School” Sales Tax Holiday Runs Aug. 1-5

- Take Advantage of DWD’s Small Business Capacity Building Sessions

- Stay Informed: Visit WEDA’s Economic Development Newswire

- Welcome New WEDA Members

President’s Message: Heather Wessling

Finding the right opportunities, securing the best projects, and following deliberate ways to improve practices through the process of economic development spawns meaningful change throughout our communities. Let’s learn from each other.

Finding the right opportunities, securing the best projects, and following deliberate ways to improve practices through the process of economic development spawns meaningful change throughout our communities. Let’s learn from each other.

This year, WEDA promises to offer our best programs yet, and with so much going on, you are not going to want to miss what we have planned.

The Community & Economic Development Awards (CEDA) program announces some of the most exciting economic development achievements that have happened across the state of Wisconsin. This year’s CEDA event is scheduled for September 12th in Madison, hosted at the Edgewater Hotel. Awards will be given in six categories: Business Retention and Expansion, Economic Driver, Human Capital, Real Estate Redevelopment and Reuse, Economic Development Initiative, and Public-Private Partnership.

If you are new to the profession, or seeking certification, the Basic Economic Development Course is designed to provide an understanding of the fundamental concepts, theories, methods and practices, taught by professionals who have earned the Certification in Economic Development from the International Development Council’s professional accreditation program (CEcD designation). The course will begin Monday and end Thursday, September 10 – 13, 2018, hosted at the UW-Madison campus.

Two weeks later, from September 26-28th, WEDA hosts our annual 2018 Fall Conference: Unpacking your economic development toolbox. The conference promises in-depth sessions demonstrating practical tools to drive economic growth. Attendees will interact with experts and learn about the newest economic development programs for implementation. Our conference is held at Lambeau Field in Green Bay, WI this year.

To register and find out more about these upcoming events, CLICK HERE to visit the WEDA website.

Executive Director’s Corner

Over the next several months, WEDA will be holding several meetings with financial institutions and workforce, community, and economic development professionals as part of the CRA Network. The CRA Network is seeking your projects and ideas for potential presentation to the regional meetings of the CRA Network. Please CLICK HERE to view application.

Network is seeking your projects and ideas for potential presentation to the regional meetings of the CRA Network. Please CLICK HERE to view application.

Following the recent tragedy in Sun Prairie, we have invited city staff to provide an update to banking participants at the regional meeting in the Madison area. This provides an opportunity to understand the different efforts that are being undertaken by the community, residents, and the various state agencies to address the needs of the neighborhood and the businesses in the affected area.

Individual banks have been quick to respond to the community needs. The CRA Network session will be an opportunity to enhance the already implemented collaboration and coordination in the community and identify any additional needs apart from the initial response. This session will be focused on working with officials to be sure the health of the local community and the long-term interests of each lending institution in the marketplace are considered.

Be sure to submit your application to the CRA Network so it can be part of our regional meetings in August, September, and October. Visit the WEDA website to learn about the meeting dates. As part of these meetings, a reception or lunch will be held to introduce the service to our regional professionals. In addition, WEDA will launch regional update and listening sessions to provide members greater access to WEDA staff as part of this effort.

New Networking Opportunities

WEDA recently created a new LinkedIn group for individuals new to the economic development profession in 2018. The online networking group will allow these professional to interact and discuss topics and best practices as they work on projects within your organization. It will also allow each of the participants to understand the diverse skills sets and expertise of the cohort. This group is by invitation only. If you have staff new to the profession that would be interested in joining this networking group, please have them reach out to WEDA at weda@weda.org.

Have a great rest of the summer. I look forward to you being part of WEDA’s fall programming and other exciting opportunities.

WEDC Bulletin

An economic development update from the Wisconsin Economic Development Corporation

Green Bay Packaging. announces $500 million expansion

Green Bay Packaging Inc. has announced an investment of more than $500 million that includes a construction of a new recycled paper mill and an expansion of the company’s shipping container division – a project expected to create 200 jobs throughout the state.

project expected to create 200 jobs throughout the state.

With $500 million in capital investment, the expansion of Green Bay Packaging will be one of the largest economic development projects in state history and the largest ever in Brown County. WEDC is supporting the project by providing the company with up to $60 million in tax credits over 12 years.

The new state-of-the-art recycled paper mill will replace an existing recycled paper machine that was originally built in 1947 and has been rebuilt three times since. The new mill, which will cost over $475 million and take three years to build, will last more than 50 years, company officials say. Building the new mill in Green Bay will enable the company to continue to grow in Wisconsin and could result in other long-term investments in the state.

Milwaukee Tool expansion project receives support from WEDC

WEDC has awarded Milwaukee Tool Co. with up to $8 million in state tax credits to support the company’s plans to build a $32 million R&D facility in Brookfield – a project expected to create 350 new jobs.

“A little more than two years ago, Milwaukee Tool announced the expansion of their headquarters creating nearly 600 jobs in Brookfield, and now we are here today to announce yet another expansion that will create 350 more jobs,” said Governor Walker, who joined company officials in a ceremonial groundbreaking event at the company’s headquarters on July 13.

Milwaukee Tool’s newest expansion project will occupy a 3.5-acre site and will be part of the company’s expansion of their Global Headquarters Campus. This newest expansion will house the company’s advanced manufacturing, engineering, and global research and development center.

WEDC supports three communities with state grants to spur downtown development

WEDC has awarded three Community Development Investment grants to cities across Wisconsin. These grants help support development in downtown communities:

- Beaver Dam received a $126,100 grant to help finance the redevelopment of a vacant building into a new downtown microbrewery. The grant will support renovations of an existing, vacant building located on a 14,900-square foot lot, which had been a used car sales lot, to make room for a state-of-the-art microbrewery called Ooga Brewing Co.

- Janesville received a $250,000 grant to help finance the construction of a new downtown hotel. The grant will support the new construction of a Cobblestone Hotel & Suites, a 53-room, four-story hotel overlooking the Rock River. The 33,000-square-foot hotel will include an indoor pool, an exercise facility and a restaurant.

- Fond du Lac received a $250,000 grant to help fund the renovation of the historic Hotel Retlaw. The grant will support the redevelopment of the property into a full-service hotel providing affordable luxury with modern amenities, a restaurant and a meeting space.

J.W. Speaker Corp. to expand operations in Germantown

J.W. Speaker, a family-owned specialty lighting manufacturer, is expanding its manufacturing facility by an additional 140,000 square feet in Germantown – a $46 million project expected to create 100 new jobs over the next three years.

WEDC is supporting the project by authorizing up to $450,000 in state income tax credits over the next three years. The actual amount of tax credits J.W. Speaker will receive is contingent upon the number of jobs created and the amount of capital investment during that period.

The expansion will provide the company flexibility for its current operations, help alleviate capacity constraints, and allow for additional expansion in the future.

Drexel Building Supply to expand in Columbia County

Drexel Building Supply Inc., a leading provider of building materials and design services to professional contractors and homeowners, is constructing a new facility in Columbus, a $2.1 million project expected to create 113 new jobs over the next three years.

To support the expansion plans, WEDC has authorized up to $445,000 in state income tax credits over the next three years. The actual amount of tax credits Drexel will receive is contingent upon the number of jobs created and the amount of capital investment made during that time.

WEDC supports four communities with state grants to redevelop idle sites

WEDC has awarded four cities with $500,000 each as part of the Idle Sites Redevelopment Grant program. These grants are used to implement redevelopment plans for large industrial sites that have been idle, abandoned or underutilized. The four recipients are:

- Janesville received a grant to support the redevelopment of the former General Motors plant and will offset the costs of razing six buildings on the 114-acre assembly plant area, including the 3.9-million-square-foot main plant Prior to its shuttering nearly a decade ago, the property’s history includes the manufacturing of farm implements, automobiles, trucks and even artillery shells.

- Town of Grand Chute received a grant to redevelop the site of the former National Envelope Corp. building. The grant will help offset the costs of demolishing existing structures and associated infrastructure of the 300,000-square-foot building. Now that demolition is complete, the site will be redeveloped into the new home for WG&R Furniture, a family-owned business with nine locations in northeastern Wisconsin.

- Hudson received a grant to redevelop the former St. Croix Meadows Greyhound Racing Park to make way for a new $200 million mixed-use development which will include a baseball stadium, a hotel with conference center, corporate office space, technology and research facilities, restaurant, an indoor sports complex, and condominiums. The baseball stadium will be the home of the St. Croix River Hounds, a team in the Northwoods League that will begin play in 2019.

- Madison received a grant to redevelop the former Oscar Mayer plant as it reconfigures outdated infrastructure at the site to deliver gas and electricity to each individual building on the 67-acre parcel. The work also includes upgrades at the buildings to comply with the federal Americans with Disabilities Act.

Guest Column

Wisconsin on Great Financial Footing to Win 21st Century

By Secretary Ellen Nowak – Wisconsin Department of Administration

With the state’s employment at an historic high, unemployment at an historic low, and companies like technology manufacturing giant Foxconn and paper industry leader Green Bay Packaging choosing Wisconsin to locate or expand operations, Wisconsin is well on its way toward winning the 21st century.

With the state’s employment at an historic high, unemployment at an historic low, and companies like technology manufacturing giant Foxconn and paper industry leader Green Bay Packaging choosing Wisconsin to locate or expand operations, Wisconsin is well on its way toward winning the 21st century.

Thanks to common-sense reforms, smart fiscal management and continuing economic growth, our state budget has entered a new fiscal year in an outstanding position.

Both property and income taxes are lower this year than they were in 2010, and we have ended every fiscal year since 2011 with a surplus, including a larger-than-expected surplus that allowed more than a half-million Wisconsin households to receive a $100 per-child sales tax rebate in recent weeks. Looking ahead, the Back-to-School Sales Tax Holiday will run from August 1 – 5, 2018, helping families save money when they buy school clothing, computers and supplies.

In the current state budget, we eliminated the state property tax for the first time since 1931 and we continued to deliver income tax relief, all while managing our state’s finances in a smart, effective and prudent fashion that also allowed us to make record investments into K-12 education. Working in partnership with the Wisconsin Legislature, the state has delivered thousands of dollars in income and property tax relief to typical Wisconsin families since the Governor took office.

Today, our state’s budget and financial outlook are strong. Consider the following:

- Wisconsin is paying off more debt than it is taking on to the point where outstanding obligations are the lowest they have been in nearly a decade and dropping.

- Good debt management and taking advantage of low interest rates has allowed taxpayers to realize $633.7 million of debt service savings since 2011.

- Of the $137.5 million added to our current budget surplus in the last state general fund update, $77.8 million of that was debt service savings.

- The state’s revenues are higher than previously estimated, the state’s rainy-day fund is at the highest level ever, and it is also estimated to exceed $300 million at the end of this fiscal year.

- Wisconsin received bond rating upgrades from three national agencies over three months in 2017.

- The state has had the lowest new bonding authorized in back-to-back budgets in at least two decades, and total debt obligations have declined in four of the past five years. The state’s long-term outstanding obligations are some of the lowest in the country.

- The state’s pension system is fully funded and strong, creating long-term budget flexibility to make additional investments in our priorities.

Our good fiscal management has also allowed for the inclusion of more than $6 billion for transportation, including the largest increases for local governments to fix roads, repair bridges and fill potholes in at least two decades.

Reducing the tax burden, historic investments in education and roads, and good fiscal management have contributed to the historic positive results for Wisconsin. The unemployment rate is at a record low, employment is at an all-time high and the state’s per capita GDP growth rate ranked 11th highest in the nation from 2010-17.

The state’s finances are in great shape, and we are ready to win the 21st century.

Latest Edition of WEDA’s Toolbox Newsletter Now Available Online

The latest issue of WEDA’s Toolbox Newsletter is now available online. The Toolbox Newsletter provides WEDA members and our economic development partners with an overview of available economic development tools and how they can be used to benefit communities across Wisconsin. Each edition offers insight into the programs and policies used in Wisconsin to drive economic growth.

This edition of the Toolbox focuses on Wisconsin’s Community Development Investment (CDI) grant program, which helps transform communities across the state by providing matching funds to support shovel-ready projects that focus on revitalizing a community’s downtown area or commercial center. It also provides an overview of an how the CDI Grant program helped the City of Sheboygan address its housing shortage, drive downtown retail and commercial activity, and anchor its Arts and Culture District.

CLICK HERE to view the Toolbox Newsletter on the WEDA website.

WEDA Legislative Spotlight

We may still be in the dog days of summer, but January will be here before we know it, and with it the beginning of a new legislative session.

We may still be in the dog days of summer, but January will be here before we know it, and with it the beginning of a new legislative session.

While WEDA’s Legislative Committee has determined the broad issue areas we will advocate for at the State Capitol next year, the committee continues to discuss and identify specific legislative proposals for potential inclusion in WEDA’s 2019-20 Legislative Agenda. WEDA would also like to provide all association members the same opportunity to weigh-in on our Legislative Agenda.

Outside of a handful of miscellaneous issues, such as efforts to close the dark store property tax loophole in Wisconsin, WEDA’s legislative priorities for next session will fall into one of the following general issue categories:

- Workforce Development – Talent attraction and retention; workforce training; and workforce housing policies and legislation.

- Tax Incremental Financing – Reforms to Wisconsin TIF law to increase the effectiveness of TIF and provide communities greater flexibility in utilizing the most important local economic development tool in Wisconsin.

- Rural Economic Development – This category includes, but is not limited to proposals to enhance and create programs to drive economic prosperity in rural Wisconsin, such as broadband expansion, operational funding for locals EDOs, and support for local revolving loan funds.

If you have any ideas for a legislative or regulatory proposal (that fits into one of the issue categories listed above) for potential inclusion in WEDA’s 2019-20 Legislative Agenda, please contact the WEDA office at weda@weda.org.

Wisconsin’s “Back-to-School” Sales Tax Holiday Runs Aug. 1-5

Earlier this year, the Legislature passed legislation to create a “back-to-school” sales tax holiday in early August. Under the legislation as signed by the governor, the five-day sales tax holiday will run from Aug. 1 through Aug. 5. The tax holiday is estimated to reduce state revenues by nearing $15 million.

During the sales tax holiday, shoppers will be able to purchase the following items tax free:

- Clothing that costs no more than $75 per item;

- Personal computers of $750 or less;

- Personal computer supplies of no more than $250 per item; and

- School supply items with a sales price $75 or less

Certain items will remain taxable during the sales tax holiday, including: Sports or recreational equipment; protective equipment; clothing accessories, such as jewelry or watches; school art supplies; and school instructional materials, such as textbooks.

For more information on the upcoming sales tax holiday, please visit the WI Department of Revenue website.

Take Advantage of DWD’s Small Business Capacity Building Sessions

LACK OF ACCESS to working capital, prime contractor decision-makers, and quality, trained job candidates are key barriers blocking smaller contractors from participating in more of the over $6 billion in  Wisconn Valley industrial, transportation, and utilities construction projects. Those are among the findings of a survey the Wisconsin Department of Workforce Development conducted in Second Quarter 2018.

Wisconn Valley industrial, transportation, and utilities construction projects. Those are among the findings of a survey the Wisconsin Department of Workforce Development conducted in Second Quarter 2018.

That’s why the State of Wisconsin and its partners have collaborated to design tools to help smaller contractors overcome the access barriers and compete more effectively for Wisconn Valley contracting.

Please join DWD and Wisconsin Housing & Economic Development Authority (WHEDA) for one of its Wisconn Valley Small Business Capacity Building Sessions. The sessions provide an opportunity for businesses to learn how they can gain greater access to:

- Working capital and participating lenders

- Prime contractors and other key decision-makers

- Quality, trained job candidates and potential wage subsidies

- Tax credits that can improve a business’ bottom line

In addition to barrier-busting product and service presentations, there also will be opportunities to network with participating lenders, business association/resource executives, and fellow contractors.

The State of Wisconsin, Foxconn, Wisconsin Housing & Economic Development Authority, Gilbane Building Company, M + W Group, Racine County, Cities of Milwaukee and Racine, Village of Mount Pleasant, National Association of Minority Contractors, Gateway Technical College, Racine County Economic Development Corporation, Legacy Redevelopment Corporation, UMOS, and so many more partners are committed to collaborating to ensure businesses of all sizes and backgrounds have an opportunity to participate in more of the unprecedented volume of Wisconn Valley construction projects.

Session Details:

- Session 1 – Aug. 15 from 8:00 a.m. to 11:00 a.m. at UMOS, Inc. (2701 South Chase Avenue, Milwaukee, WI)

- Session 2 – Aug. 24 from 8:00 a.m. to 11:00 a.m. at the S.C. Johnson iMET Center (2320 Renaissance Boulevard, Sturtevant, WI)

Please CLICK HERE to register.

STAY Informed: Visit WEDA’s Economic Development Newswire

Get the latest state and national economic development news and headlines in one place on WEDA’s Economic Development Newswire.

Welcome New WEDA Members

WEDA would like to welcome and thank the following new members for joining the Association:

- Karen Gotzler, Urban Strategies

- Betsey Harries, Ashland Area Development Corporation

- Kathleen Heady, Retired member

- Paul Melnick, CIBM Bank

- Aina Vilumsons, Retired member