WEDA Continues Work on Legislative Priorities

Now that the state budget process is nearly over (if Gov. Evers signs the budget bill and decides not to veto it in full), the legislature will hopefully turn their attention on other important legislative issues not addressed in the budget bill. WEDA itself has a long list of legislative priorities we would like to get over the finish line before the end of the current session. Those priorities range from initiatives to help address the state’s workforce shortage and affordable housing crunch to proposals to strengthen critical economic development tools.

Due to the current political landscape in Wisconsin and the nature of split-government, the quantity of proposals moving through the legislative process is measurably less than in recent sessions. Despite the slower activity in the State Capitol, the WEDA Government Affairs Team WEDA looks forward to working with lawmakers during the remainder of the session to help advance economic prosperity in Wisconsin. In fact, WEDA has a handful legislative initiatives lined-up for introduction and further consideration in early fall, including:

Opportunity Zone Enhancement Act – In 2017, Congress enacted the federal Opportunity Zone Program to help drive long-term private capital to economically challenged rural and urban communities across the country. Each state has designated a set number Opportunity Zones into which private investment can flow through Opportunity Funds – a new private investment tool authorized to invest in Opportunity Zone projects. Wisconsin has 120 Opportunity Zones.

In 2017, Congress enacted the federal Opportunity Zone Program to help drive long-term private capital to economically challenged rural and urban communities across the country. Each state has designated a set number Opportunity Zones into which private investment can flow through Opportunity Funds – a new private investment tool authorized to invest in Opportunity Zone projects. Wisconsin has 120 Opportunity Zones.

Investors realize the following tax benefits if they reinvest unrealized capital gains into an Opportunity Fund: 1.) Deferral of capital gains tax until 2026; 2.) Reduction of original capital gains tax by 10% after 5 years, and by 15% after 7 years. Last session, Wisconsin incorporated the federal tax provisions related to Opportunity Zones into state law; and 3.) A permanent exclusion from taxable income of capital gains from the investment in an Opportunity Fund.

The legislation WEDA is working on would double the Opportunity Zone tax incentives at the state level for Wisconsin investors who invest In Opportunity Funds that in-turn hold at least 90% of their assets in Wisconsin Opportunity Zone property. The bill will help drive much-needed, long-term investments to communities across Wisconsin.

The legislation is currently being redrafted to incorporate a handful of necessary technical modifications, but should be ready for introduction and legislative debate in late summer or early fall.

Workforce Housing Development Tax Incentive – Communities across Wisconsin are dealing with a growing rental and workforce housing shortage, which negatively impacts talent attraction efforts and stalls economic growth. WEDA is working on legislation that would help encourage the development of workforce housing by creating a sales tax exemption on building equipment and supplies purchased to construct workforce housing. The legislation should be introduced by early fall, either as a stand-alone bill or as part of a wide-ranging rural economic development bill.

Transportation Economic Assistance (TEA) Grant Enhancement Bill –

The TEA Grant program, administered by the Wisconsin Department of Transportation (DOT), was created in 1987 to provide funding for transportation improvements critical to economic development projects that retain and create jobs in Wisconsin. The program was established to respond quickly to economic development opportunities that support business investment across the state.

Since its inception, the program has awarded over 350 grants statewide totaling more than $110 million. In addition, TEA Grants have helped fund road, rail, harbor and airport projects that have resulted in the creation of over 27,000 new jobs and the retention of more than 19,000 jobs.

Unfortunately, after a recent legal review of the program, the DOT determined it did not possess the statutory authority to provide grant funding for jobs retained – and going forward could only support projects that create new jobs. This change has diminished the value of TEA Grants as an economic development tool. It is also in direct conflict with Wisconsin’s growing workforce shortage, which makes it necessary for state programs and policies to recognize that job retention is just as important as job creation.

WEDA is working on legislation that would restore the TEA Grant program’s long history of awarding project funds for both job creation and job retention.

The bill has been circulated for co-sponsorship, and over 25 legislators from both sides of the political aisle have signed onto the bill as sponsors. The legislation should be officially introduced and assigned a bill number within the next week.

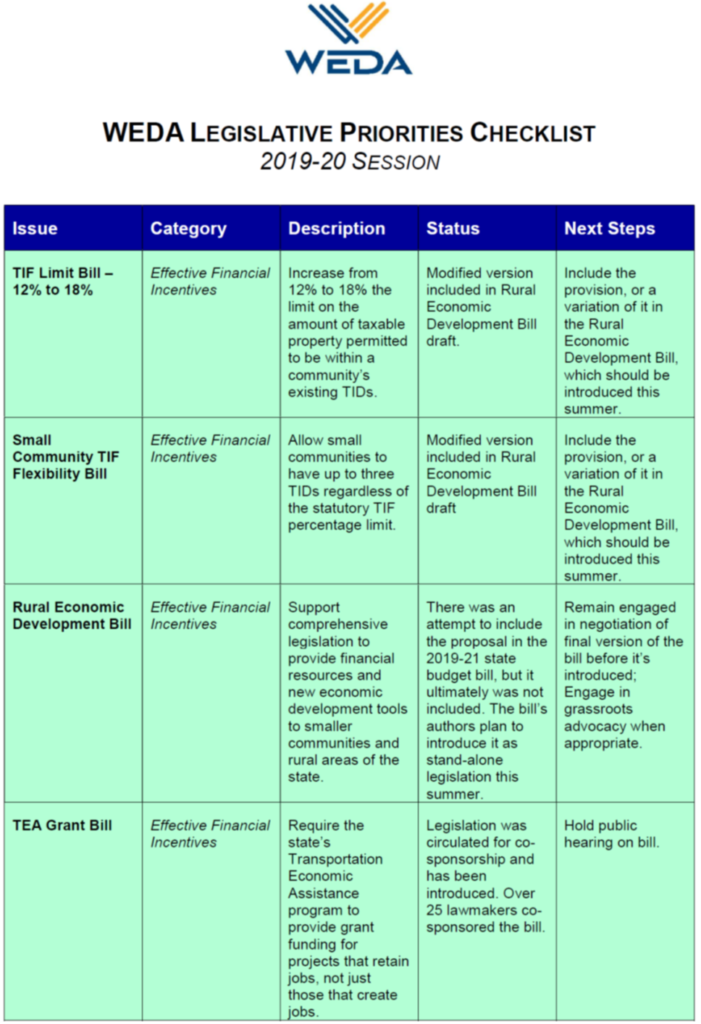

To learn more about WEDA’s legislative goals for the rest of the session and the status of each issue we’re working on, CLICK HERE to review our Legislative Priorities Checklist.